CVS Health prepares for a meeting with activist investor Glenview Capital amid stock challenges, while Johnson & Johnson faces penalties over changes to its 340B program.

Introduction

Good morning, and welcome to the start of another working week! As the familiar routine of meetings, deadlines, and emails returns, we hope you’re feeling recharged and ready to tackle the tasks ahead. For today’s coffee of choice, we’re opting for a stimulating double shot of maple bourbon brew—perfect for those Monday morning neurons. As we settle into the rhythm of the week, here are a few key updates in the healthcare sector to get you started. From activist investors eyeing CVS Health to regulatory warnings for Johnson & Johnson, it’s shaping up to be an interesting week.

Activist Investor Targets CVS Health for Operational Improvements

CVS Health, one of the most recognized names in the healthcare industry, is facing scrutiny from hedge fund Glenview Capital Management, signaling potential activist intervention. The Wall Street Journal reports that Larry Robbins, founder of Glenview, is set to meet with CVS Health executives, including CEO Karen Lynch, to propose ways the company can improve its operations. This meeting comes at a time when CVS’s stock has tumbled 24% year-to-date, causing investor restlessness.

Glenview Capital has accumulated a significant position in CVS, and Robbins is expected to present strategies to energize the company’s performance. While there is no indication that the hedge fund will push for a breakup of the company, the meeting may mark the beginning of activist efforts to influence CVS’s trajectory. Investors and industry analysts will be watching closely as the company navigates this challenging period, with potential changes on the horizon.

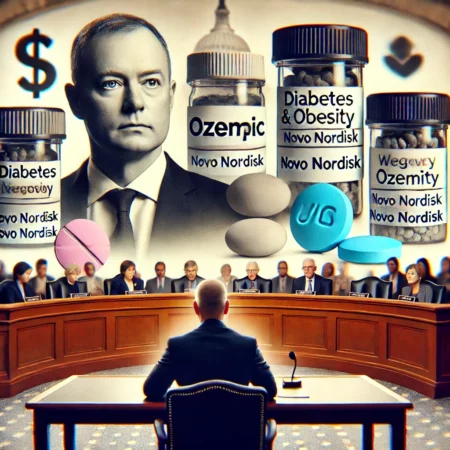

Johnson & Johnson Faces Regulatory Showdown Over 340B Program Changes

In a separate development, Johnson & Johnson (J&J) is under increasing pressure from the U.S. Health Resources and Services Administration (HRSA) regarding its plans to alter payment methods for hospitals participating in the 340B drug discount program. J&J recently announced that starting October 15, it would issue rebates for two widely prescribed medicines instead of offering discounted prices upfront. However, HRSA has warned that this move would violate federal law.

In a final warning letter sent to J&J, the HRSA argued that requiring hospitals to purchase medicines at prices higher than what the 340B program allows would be unlawful. The agency also stated that any changes to the program must first be approved by the Department of Health and Human Services (HHS), which oversees the program. If J&J does not comply, it could face penalties of $7,000 per violation, and its contract to participate in the 340B program could be terminated. This regulatory clash could have significant consequences for J&J as it navigates its relationship with the U.S. healthcare system.

Conclusion

As the week kicks off, both CVS Health and Johnson & Johnson find themselves at pivotal moments. For CVS, the meeting with Glenview Capital could shape the company’s strategic direction and address investor concerns over its stock performance. Meanwhile, Johnson & Johnson faces the possibility of steep penalties and further regulatory challenges if it proceeds with its planned changes to the 340B program without federal approval.

These developments are a reminder of the delicate balance companies must strike between operational efficiency and regulatory compliance, especially in the healthcare sector. Keep an eye on these stories as they unfold, and best of luck with the start of your week!